This year has put many economies and industries to the test. Company shutdowns and quarantines, supply chain problems, and news about business as usual is no longer. So, six months later, where do we stand now? Let’s have a closer look.

Green Industry

In the face of many impacts of COVID, we are glad to share good news: The Green Industry has weathered COVID amazingly well. Construction trades were trending strong before COVID and continue strong as we are coming out of the recession. Construction and Green Industry were declared essential, which has allowed work to continue during the pandemic. We are adapting to doing business in new ways: more online and more delivery. Recession losses will soon have recovered, and we are looking at two to three years of favorable forecasts for our industry.

Housing

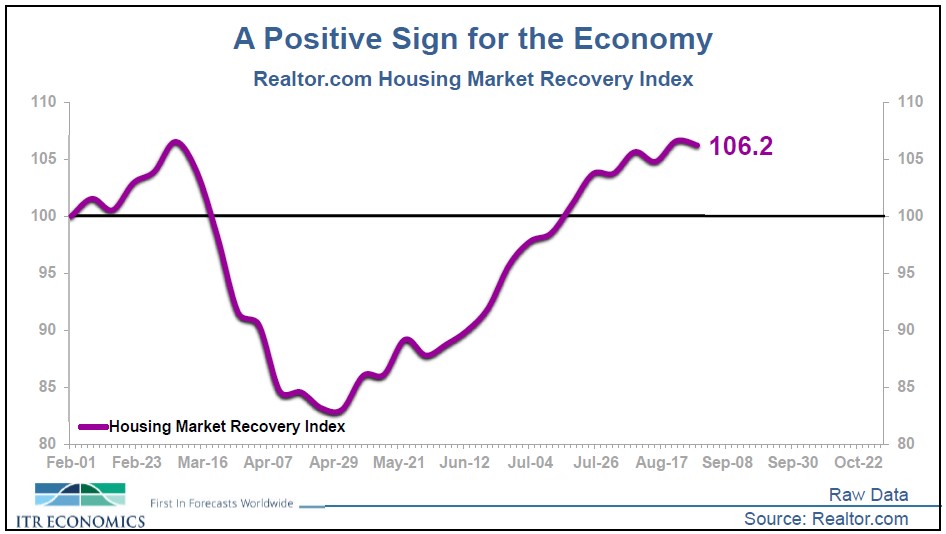

Housing has been a bright spot in this recession. Both home values and sales have bounced back very quickly, as you can see in the chart from ITR. At the same time, because people were stuck at home, renovations skyrocketed. The renovation demand will continue, which of course includes landscaping projects.

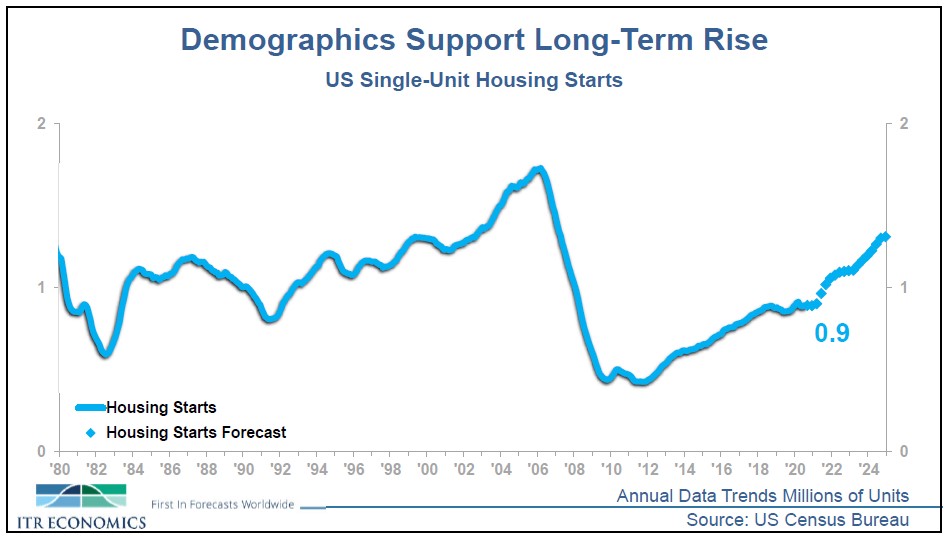

Another bright point is new home construction starts. They are picking up and predict to be strong through 2024, as you can see in the ‘Demographics Support Long-Term Rise’ graph.

Multi-Family Housing starts have lowered since 2019 and promise to level at the 2015 market volume, which all-in-all, isn’t all that bad.

Office Projects

Office construction projects have been declining and will continue to drop from the 2018-19 boom. They are expected to level off at the levels from before the spike.

I hear concerns from contractors that commercial construction will not grow because COVID has forced many to work remotely, and that this trend will continue. Actually, remote working trends were already increasing prior to COVID, because improved internet and technology have made that possible. We can also see that with the increasing trends in online education and training, in which Wolf Creek participates as well.

While Millennials and Gen Z thrive in online environments, many other workers find it difficult to maintain their productivity when working from home. People are social and want to congregate and work together in person. People will continue to innovate and figure out different ways to work together. We already see that businesses, educational institutions, and government entities have adapted their office use with appropriate precautionary measures. It may take some time for the new construction starts to adapt to that need for change. In the meantime, renovation of existing private offices is booming and provides many opportunities for the Green Industry as well.

Other Construction

- Education & Medical: Education facilities starts have shown a slight decline but are now leveled and holding for the next few years. Medical faculties are showing deep decline until 2022.

- Multi-Tenant Retail Construction severely dropped off starting in 2018. Online buying caused many small retailers to suffer, and the COVID restrictions are killing them off. Don’t expect much retail building for a while.

- Warehousing: Online buying and the COVID recession have both contributed to a drastic demand for more warehouse space. Warehousing is a booming business and offers great commercial landscaping opportunities.

Recovery Ahead

Our general economy is in recovery mode from the COVID recession. Most sectors are improving, however not all are recovering at the same pace. Especially the hospitality industry has a multi-year recovery ahead. Hotels, amusement parks, theatres, restaurants, airlines, stadiums, bars, and convention centers have been highly restricted during COVID, although the recent Labor Day holiday weekend offered a promising trend. (Hospitality.net)

Stock Market

Many of you follow the stock market, which provides a decent indicator, because traders look ahead to the next few months. However, be aware that the markets prefer certainty, so periods of uncertainty will cause short-term declines. The volatility of the day-to-day market can be unnerving, so I recommend and follow the long-term trending, not the daily or weekly gyrations.

Politics

I also hear strong concerns about the upcoming elections but let me put this in perspective. History teaches us that party control of Washington has little to-do with economic growth. Politicians like to claim ownership of the economy; however, the economy is much too complex and too big for politicians to “control”. We, The People, control the economy. Politicians can only throw up or remove minor roadblocks; a contested election result could be one of those roadblocks.

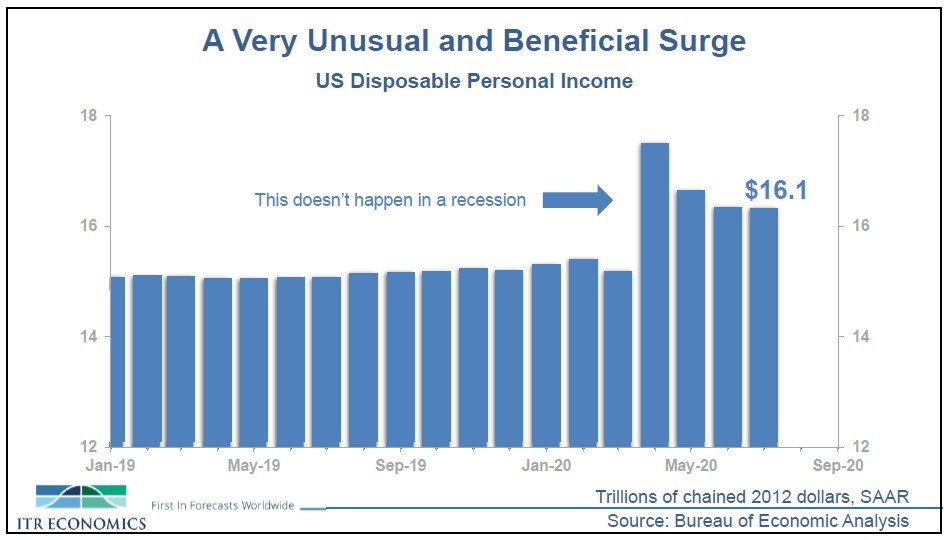

Personal Income

An interesting effect from the COVID recession is an overall increase in personal income. This has not happened in any previous recession and is an indicator for a good recovery. A well-functioning economy requires several factors, but I consider personal income the bedrock of an economy.

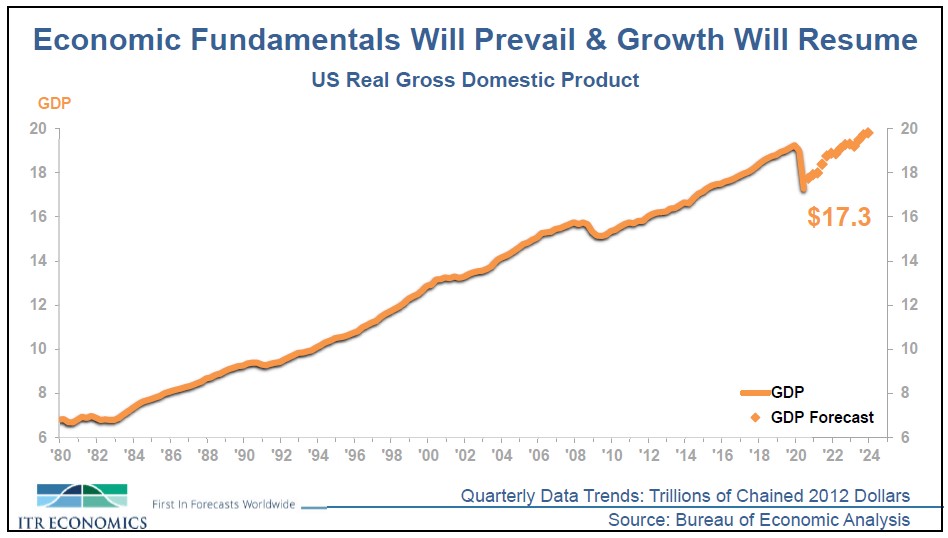

Gross Domestic Product (GDP)

GDP is a general measure of how much wealth is being created. A healthy economy shows an increasing GDP, and the forecasts show that the GDP will grow at least through 2024.

In Conclusion

The Green Industry is a great place to be for the near future. The economy is recovering from the COVID recession and as always, the market will adapt. The housing market will drive sustained, increasing construction business for the next several years, and the Green Industry can rest assured that there is plenty of work ahead.

Between new home construction and renovation in both commercial as well as residential markets, there are many opportunities. Give us a call if you want to discuss how to position your landscaping company for the coming years ahead.

Read more Green Industry articles.