Landscaping Technology Survey

Recently we wrapped up the first installment of our Annual Technology Survey. We present the findings to help you navigate the ever-changing and extremely important world of technology so you can be informed, grow your business and maximize your results!

Our Technology Survey presented 32 questions about different technologies covering all aspects of the landscaping industry. Eighty-one (81) landscaping contractors participated and will receive the full survey report once compiled. This article, first in this series, explores the use of business management software for accounting and billing, customer management, and job management.

Business Management

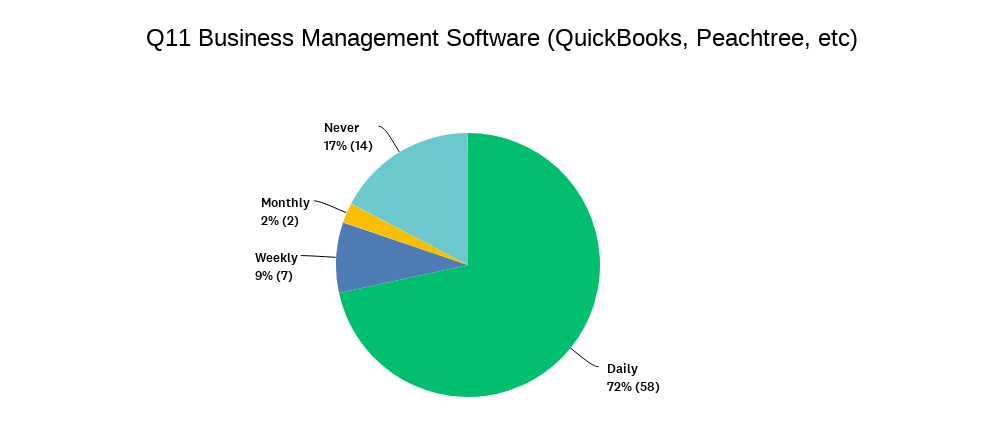

Business management includes accounting and billing. Depending on the application it may also include payroll, benefits, inventory, purchasing, and related functions. The business management program usually forms the foundation that add-on programs use for enhanced functions.

The survey shows that QuickBooks dominates. It comes as no surprise to see that most contractors (83%) use software for accounting. We do not know whether the remaining 17% do not use software or outsource their accounting to a CPA or bookkeeper.

Customer Relations Management (CRM)

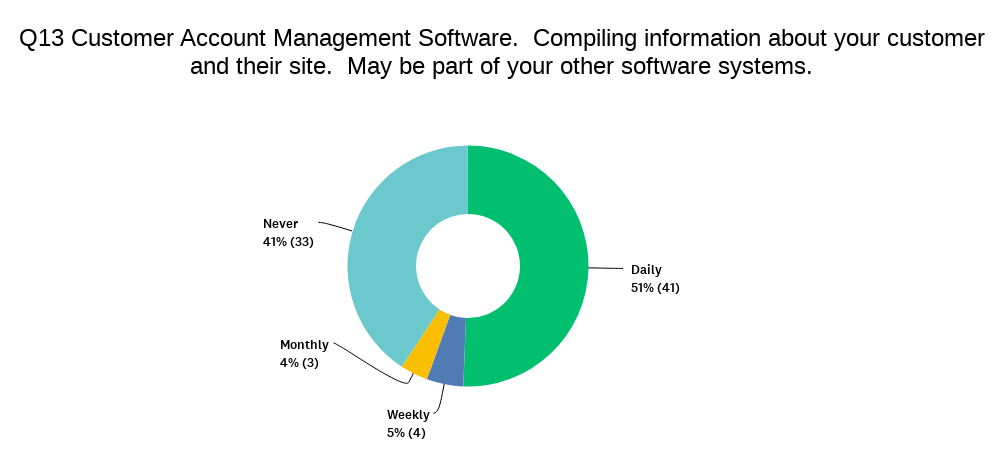

Customer management software is being used to manage customer data, which can include information about their property, personal data, and purchase history. The survey shows that HindSite and Aspire dominate this sector.

It is again not a surprise that 59% of those surveyed use business management software and possible add-on functionality. Customer data is an important part of marketing and communication. Information such as industry new, new products or services and promotions are shared via text messaging, email newsletters and social media. Beyond marketing, it is exceptionally handy for your service crew to have information about a customer’s site at their fingertips, so that they can better prepare for servicing and maintenance.

Job Management

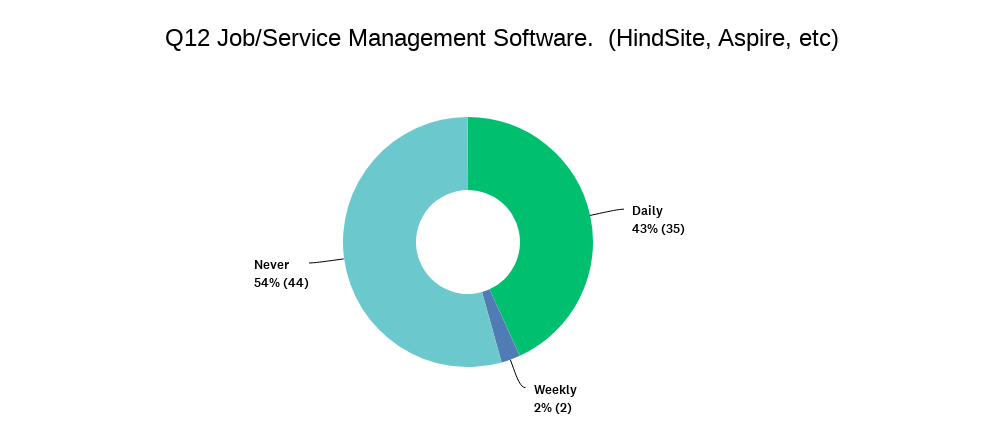

Job management software is being utilized to plan and implement a landscape or irrigation installation. This may include design, quoting, parts lists, parts ordering, hours tracking, billing, and after job storage. Some programs are fully mobile-friendly, which allows much of the work to be handled via a cell phone in the field. Other programs either run in the cloud or on your own server in-house.

A growing number of contractors (46%) are using an application to help automate and speed up job management and service functions. This percentage includes both standalone as well as add-on to management software. We know from other research that the top job management applications include Hindsite and Aspire which integrate with Quick Books.

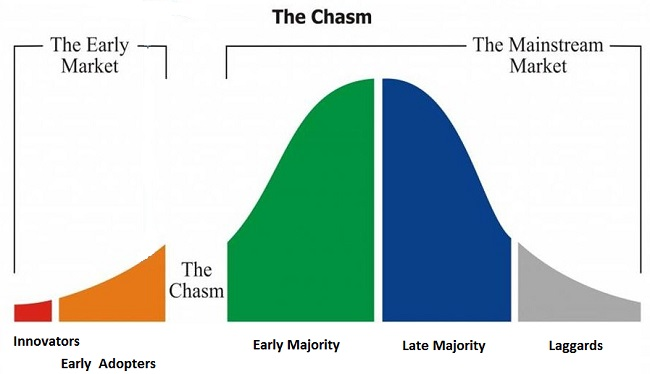

The Adoption Chasm

The above technologies for business management are used daily by large numbers of contractors, which means they are either maturing or widely accepted and mature. These applications have jumped the Adoption Chasm or are at minimum being used by Early Adopters. This Construction Executive article Crossing the Chasm: A Closer Look at Disruptive Technology in Construction provides more insight.

In our upcoming articles, we will discuss many other technologies that are trying to jump that Adoption Chasm. Which technologies will make it in the end? That is ultimately determined by what you, the landscaping contractor, will decide.

Continue learning about landscaping business technology used today in part 2 of this series.

Read more articles about Landscaping Technology

Comments